U.S. Housing Market Outlook for 2025

The U.S. housing market is projected to remain largely stagnant through 2025, with modest growth anticipated at a subdued pace of 3% or less.

Key Factors Influencing the Market:

-

Mortgage Rates: The 30-year fixed mortgage rate stands at 6.9%, down from its peak of 7.8%. Projections indicate a gradual decrease to 6.4% by the end of 2024 and 6.2% by the end of 2025.

-

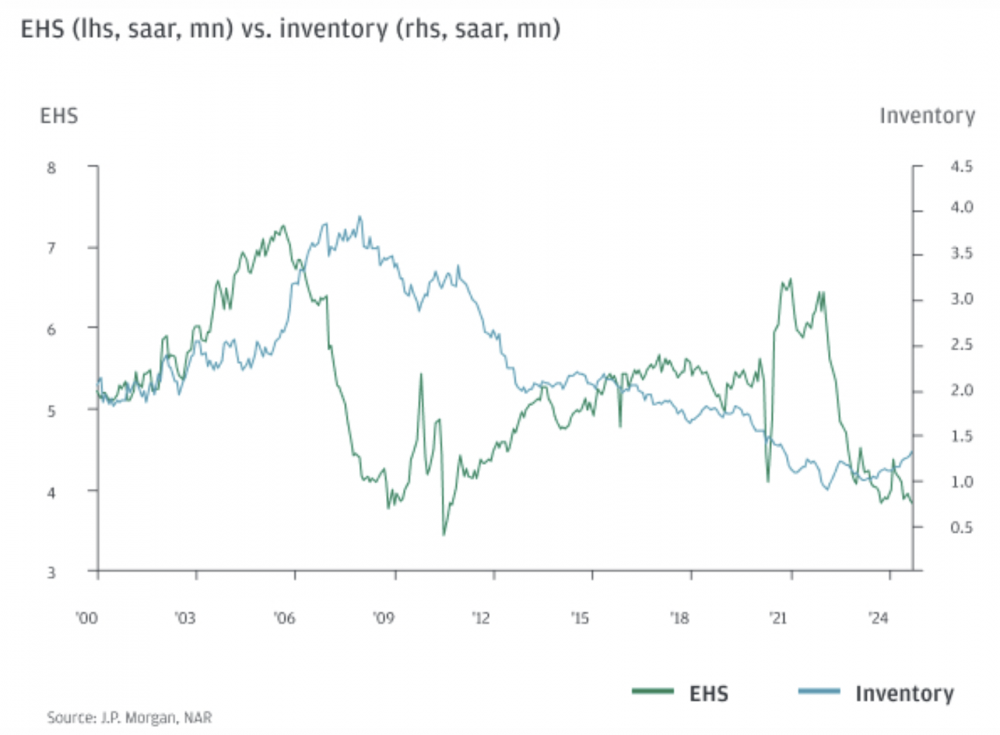

Housing Supply: The inventory of existing homes for sale remains exceptionally low, contributing to the market's stagnation.

-

Affordability Challenges: High home prices and elevated mortgage rates continue to pose affordability challenges for prospective buyers, dampening demand.

Regional Variations:

Housing markets are highly localized across the U.S., with disparities in supply and prices. For instance, areas in the Sun Belt are experiencing some recovery, while regions in the East are seeing a substantial increase in months of supply.

Long-Term Outlook:

Efforts to address the housing affordability crisis include strategies such as streamlining zoning processes, facilitating property acquisition, supporting construction innovations, and strengthening financing and development capacity. These initiatives aim to stabilize neighborhoods and stimulate economic growth.

In summary, while the U.S. housing market faces challenges in 2025, targeted strategies and market adjustments may pave the way for gradual improvement in the years to come.