Being a professional in the real estate industry and the mortgage industry I want to let you know what's my best prediction for 2023. These are only predictions I don't have a crystal ball to tell you the future of 2023 but I'm going based on data and predictions that the Fed is telling us on the interest rate hikes that have been going on from 2022. Most of the federal reserve's interest rates heights maybe in the rearview mirror but they aren't done yeah making more hikes will only worsen the real estate economy in 2023 and bring more pressure on home prices going down just like the Fed wanted to do to lower inflation rate. The Fed is looking to get the inflation rate down to 2% currently we are more than double that. The feds projections reveal interest rates have a greater chance of rising even higher then where they are now you can see their report online and you can see they are expected to peak mid 2023. Just two policymakers expect rates to lower down to 4.75 to 5% levels which is very unlikely to happen as most of them are expecting it to rise.

For the average consumers the prices they pay on mortgages or credit cards might not rise as much as they did in 2022 but they will still be amongst higher levels many borrowers have seen for decades on top of the growing recession odds showing high interest rates could put the economy into a deep recession and job market for 2023. Looking beyond 2023 outlook to 2025 is when things should normalize off and interest rates should come back down to normal they are expecting based on the recent fed report.

Currently in Orlando FL the market is suggesting that it is cheaper to rent a single family home then purchase one with a mortgage. The average consumer would be saving roughly $200 a month in cash. This does not consider how much money the consumer would be saving in principal and interest on the loan obviously it would probably be a smarter decision to purchase the home end pay your principal down. But in a down market there is also the risk of the whole value going down so many home buyers have put the brakes on purchasing at home and are renting for 2023 to see where the market goes. When they're lease is up in 2024 they are expecting to see home prices down 10% and interest rates lower and will purchase a home when the conditions are better for them economically.

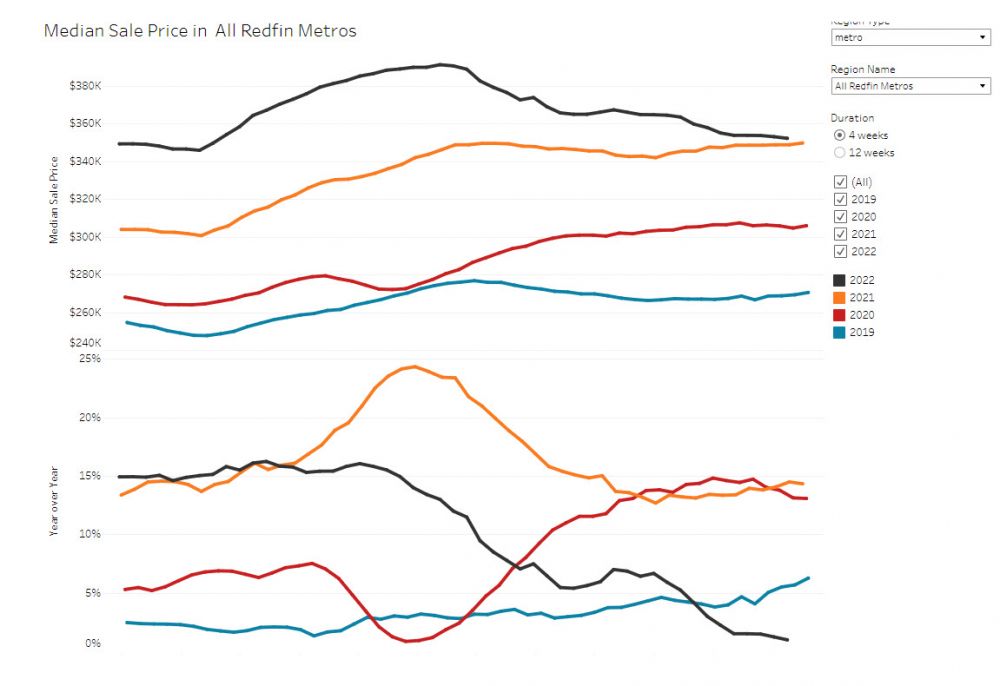

For home sellers the sooner you can sell your property and get out of it the better otherwise you will be riding the prices down slightly as interest rates increase pushing home prices down thus pushing the inflation numbers down for the Fed. on your average home peak in may of 2022 of the median average sale price of $391,000 and have lowered as of November down to $352,000 roughly a 10% decrease in six months or 1.6% drop in price each month or $6,000 per month or $200 per day. When you look at it from a dollar point instead of a percentage point it's a lot clearer that selling your home in today's market could be quite beneficial. I have advised several people to sell investment properties or sell residences and downsize or find a rental property and wait for the market to hit the trough or low in 2024 and wait out this real estate market for better days. By selling your home today you will be guaranteed more money than in the future most likely. If you wait to sell your home, you will continue to see prices decline and net more money overall if you wait if you're considering selling your home don't delay call today.

Here is a charg of the fed interest rate. This helps give you an idea how drastic the interest rates rose over 6 month!

RYAN SOLBERG, MAXLIFE REALTY AND THE MORTAGE MANIAC and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Data from Redfin.com